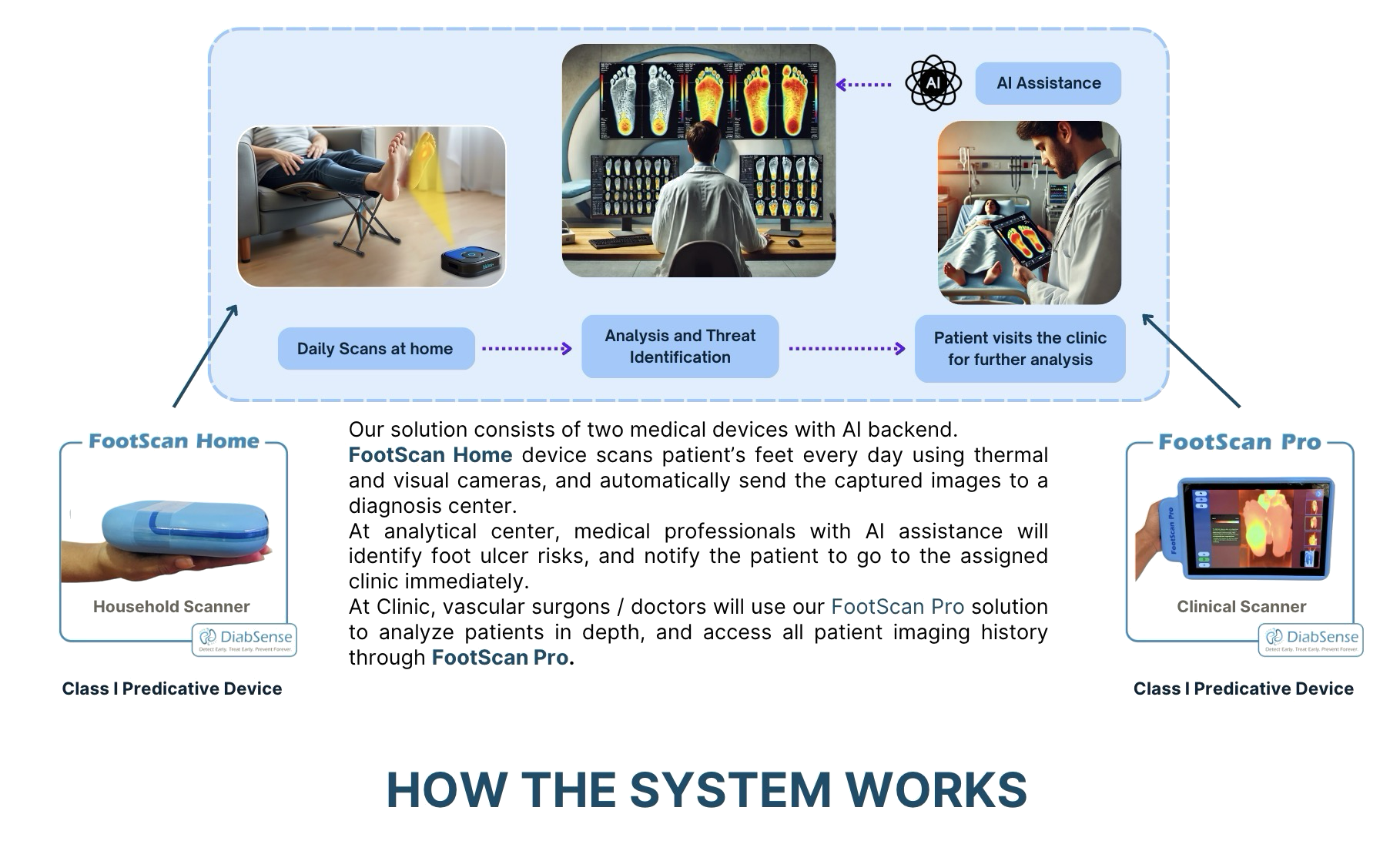

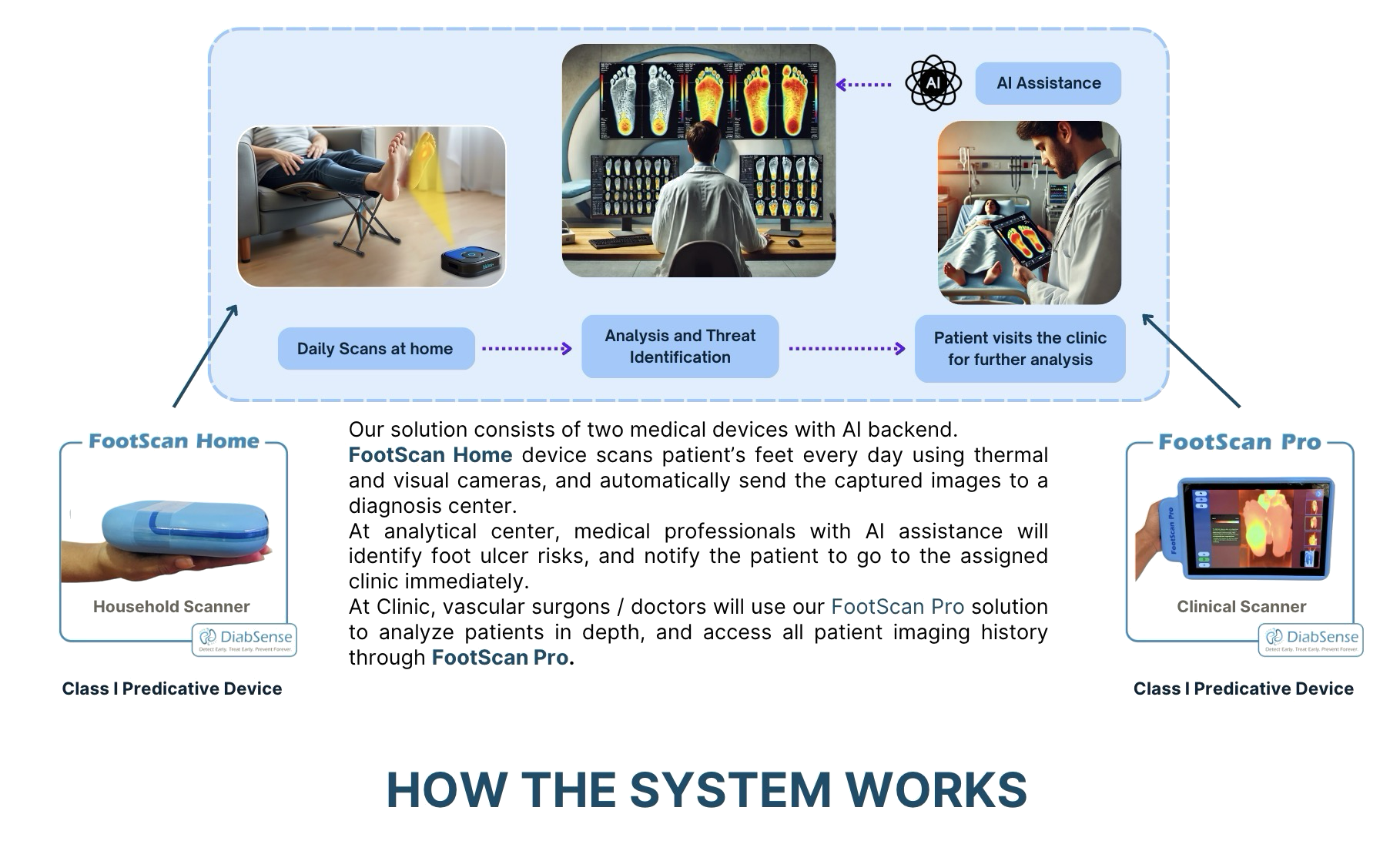

DiabSense pairs thermal and visual imaging with AI to help clinicians and high-risk patients detect hotspots, asymmetries, and other risk markers linked to ulcers and complications — non-invasively and fast.

Diabetic foot ulcers are extremely expensive, life-threatning event in deep diabetic patients. Ulceration is hard to detect beforehand, and takes a long time to cure with high blood glucose levels and lower blood circulation, commonly found in Diabetic patients

Daily feet scan at home to detect inflamation early and prevent ulceration

Deep analysis of diabetic patient feet to detect blood circulation issues early on

Continuous monitoring and characterization of wound in order to keep track of wound progress and current condition

Our clinical device for outpatient and wound-care settings. Designed for workflow speed, repeatability, and secure reporting.

An easy-to-use home device to help high-risk patients track changes between visits and escalate when needed.

20+ years in product development and business management.

16 years of expertise in electronic product development.

5 years in business management and partnerships.

Engineering background; 3 years of medical product PM experience.

Biomedical analysis and clinical program management.

Esteemed vascular surgeon; professor at Leeds and UCL (UK).

Leads local clinical trials; Sri Lankan medical advisor.

Electronics, firmware, cloud, apps, testing, and certification.

Leading Startup Hub in Estonia.

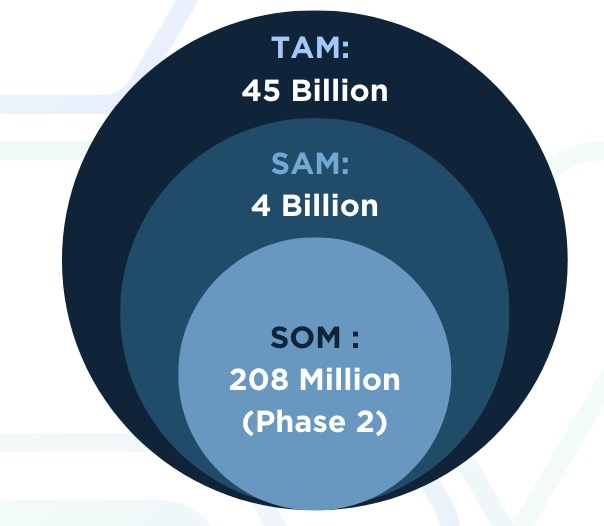

We are offering investment opportunity for interested investors at ARR above 30%.

Use the form below or email [email protected]. No data is stored on this site; your email client will open to send your message.